Cold Chain 2.0: How the latest cold chain technologies are shaping the future of food

An analysis of the cold chain market, opportunity areas, and where we see opportunity for venture-backed companies

At Supply Change Capital, we believe in the potential of innovative cold chain technologies to improve the efficiency of food and agriculture supply chains, positively impacting the environment and health. We wrote about our enthusiasm for the space last year and believe the sector offers attractive opportunities for investment.

For purposes of this analysis, we are defining cold chain technologies to include all novel technologies that reduce the environmental burden of the cold chain or improve health and safety of food products in the following areas: cold chain logistics (storage & transportation), monitoring software & IoT, optimization & forecasting software and novel food preservation technologies.

The Market

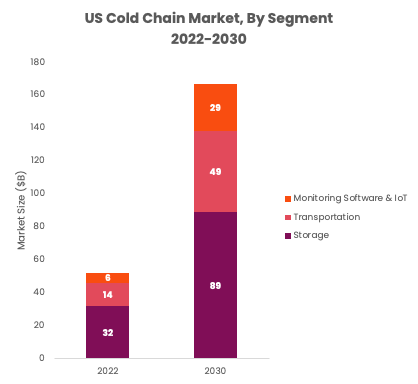

Cold chain is a large and fast-growing market. In North America, the cold chain logistics market was valued at $142.6B in 2024 (Statista), while the global market was valued at $228.3B and is estimated to grow to $372B at a ~10% CAGR in the next 5 years (Markets and Markets). As of 2021, 3.3 million square feet of cold storage construction were under development in the US, a 10x increase over development in 2019 (CBRE).

The fastest-growing segment of the cold chain market is monitoring and optimization (energy consumption, temperature, humidity, and other variables). This segment includes software, sensors, and RFID and is anticipated to quadruple in size to $29B by 2030 (The Westly Group).

Several factors are driving the growth of the US cold chain market, as visualized in the chart below:

Data presented via The Westly Group and Grandview Research

Cold Storage + Transportation

For the last several decades, fresh foods have driven growth in grocery sales (Deloitte, 2017), and recent trends show that consumers are drawn to clean-label products in pursuit of healthier foods and lifestyles (Nielsen IQ, 2024)

Consumers are placing online orders for food that requires cold chain storage and transportation. In 2021, the US saw 58% YoY growth in online sales for frozen and perishable foods (CBRE, 2021)

Monitoring/Sensors

US energy costs are outpacing inflation (Utility Dive, 2024), leading customers from cold chain storage owners to restaurant chains to look for cost-reduction solutions

Increasing rules and regulations from the FDA around cooling procedures and overall traceability of food products under the Food Safety Modernization Act (FSMA) Food Traceability Final Rule, which will be fully implemented in January 2026 (FDA, 2024)

The vast majority of cold chain shipments in the US are connected to food and agriculture: by dollar value, 84% of cold chain shipments consist of produce, meat, seafood, dairy, and other food products (The Westly Group). Up to 70% of food consumed in the US requires cold chain storage or logistics at some point along the supply chain (International Fresh Product Association).

The cold chain has a big impact on the environment: cold storage and logistics account for 1% of global emissions (CarbonTrust). The impact is even more significant when emissions related to food waste resulting from a lack or failure of proper cold chain management are considered, accounting for 4% of global emissions (UNEP).

In the food system, cold chain storage, transportation, and monitoring also play a critical role in keeping food safe for consumers to eat by preventing microbial growth and cross-contamination, as well as providing data and traceability in the event of food-borne illness outbreaks (Inspira Farms).

There are several key trends and shifts over the last year that signal a growing opportunity for cold chain:

Lineage Logistics, the largest owner of cold storage in the US, IPOed at an $18B valuation in July 2024 – the largest IPO of the year thus far.

Afresh, a grocery analytics platform, launched a partnership with Albertsons (PR Newswire) to forecast and manage inventory of cold chain food products like meat and seafood. The company raised a $115M Series B round in 2022 (Afresh) and has demonstrated considerable commercial traction since.

US online grocery sales are predicted to grow 3x faster than brick-and-mortar sales in the next 5 years (Grocery Dive, 2024), accelerating the implementation of new food distribution channels in partnership with cold storage providers like Americold (Forbes, 2019).

Opportunity Areas + Market Map

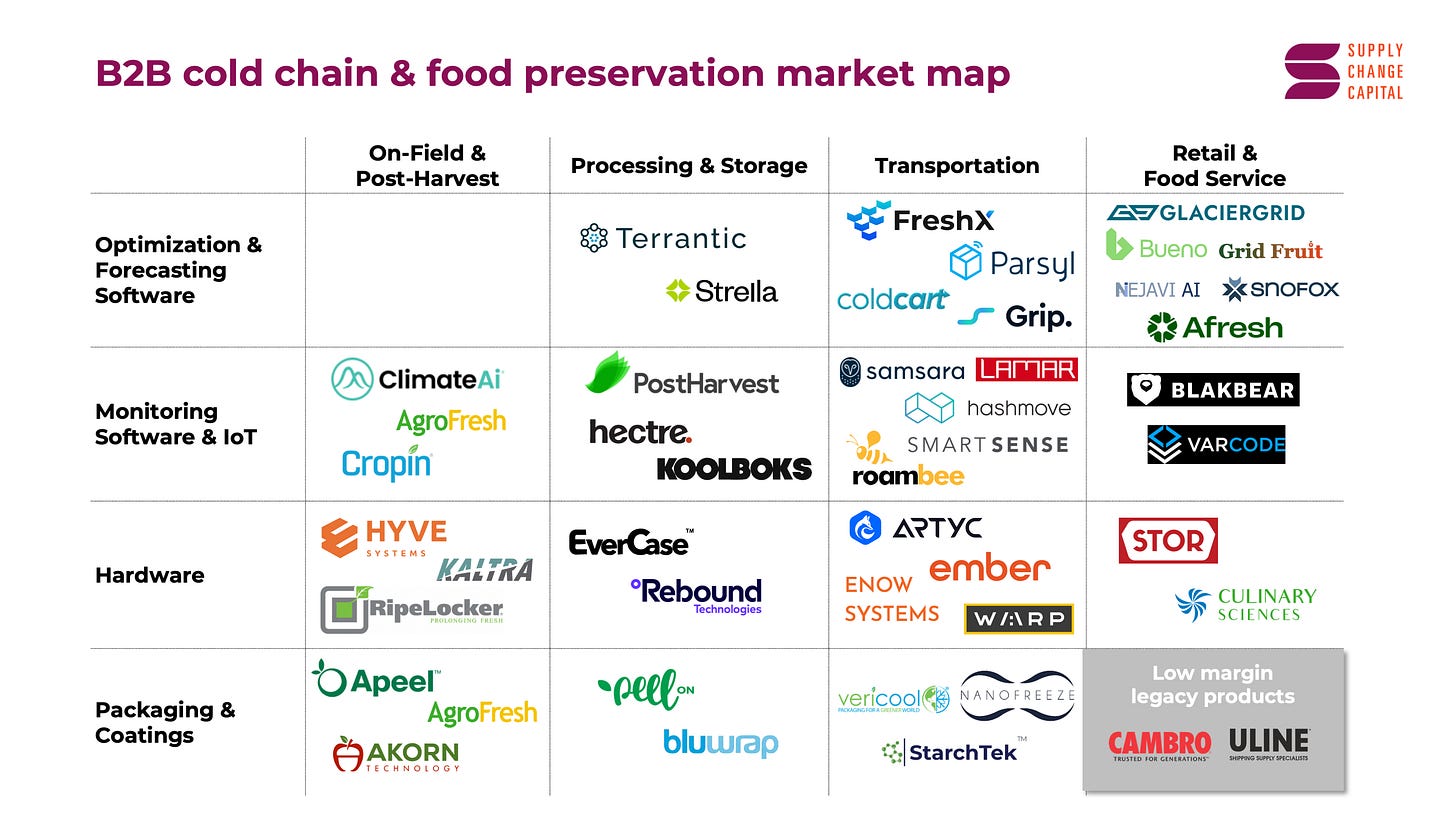

Cold chain and food preservation startups fall into four main segments:

Optimization & Forecasting Software: Software products that optimize fresh food procurement and inventory as well as energy consumption. Typically it includes an AI component.

Monitoring Software & IoT: Software products that collect and present data on temperature, humidity, and other key parameters.

Hardware: Novel technologies and machinery used to refrigerate, freeze, or otherwise preserve food.

Packaging & Coatings: Novel materials and coatings are used in place of or in supplement to existing packaging to extend shelf life or otherwise protect food in the cold chain.

56% of cold chain companies funded since 2019 are software companies, though many offer hardware and IoT/sensors to support the analytics and optimization provided to customers. 35% of these companies included IoT/sensors as a key value proposition for customers.

From our analysis, we see 3 key white spaces in the market that are ripe for innovation:

1) Forecasting and inventory optimization software in food service

4-10% of food purchased by food service is never served, and of that which is served to customers, 40% is never consumed, resulting in $218B in lost value. These losses account for the equivalent of ~1.3% of US GDP (EPA).

Software/IoT products that collects data and helps commercial kitchens and large restaurant chains optimize their inventory management and procurement processes could provide immense value to these customers. However, the pricing model will need to be sized correctly, and data collection will need to be seamless without adding onto the ever-growing list of tasks kitchen staff are responsible for.

2) Optimization software that connects demand and supply for cold chain transportation

Cold chain transportation via reefer trucks is a highly fragmented industry, with as many as 90% of carriers owning 3 trucks or less historically (Journal of Commerce).

This has left many customers purchasing cold chain transportation services, such as farms or distributors, with limited options beyond the companies they already have established relationships with. Software solutions that make it easier to instantly quote and book these services will unlock new business for logistics companies and create more choice – perhaps even lower prices – for customers.

Ex: FreshX

3) Optimization software for cold storage

Large cold chain storage companies like Lineage Logistics and Americold, which collectively represent 71% of cold chain storage facilities on the continent (CBRE), are partnering with startups and looking for technologies that will increase the efficiency of their facilities. Grocery stores, restaurant chains, and other large corporations that refrigerate many of their ingredients and products are also looking for opportunities to reduce costs while meeting their corporate ESG goals.

One-stop-shop software solutions that address multiple customer needs around cold chain are well positioned to win in this space. For example, GlacierGrid offers optimization and energy efficiency software and provides traceability that helps customers with food safety inspections at their restaurants.

Ex: SnoFox, GlacierGrid

Venture capital investments in cold chain & food preservation

Since 2019, investors have deployed more than $1.46B of venture capital into cold chain (pharmaceutical/food) and food preservation deals. This represents approximately 1% of the ~$175.7B in venture capital invested in supply chain tech overall during this time period (Q2 2024 Supply Chain Tech Report, Pitchbook).

Deal volume in cold chain and food preservation is heavily weighted toward a handful of players who have raised between $100-$500M in venture capital over the course of the last five years:

Apeel Sciences, a plant-based coating to preserve the freshness of produce

Afresh, a platform that monitors and provides actionable insights for grocery retailers on in-store food waste

SkyCell, a Swiss company that manufactures temperature-controlled and monitored hardware units for air freight

When we exclude these large raises, the average size of the most recent deal between 2019 and 2024 was $5.79M, and the average last known valuation for these deals was $33.46M.

There are no known exits among venture-backed startups in this competitive set. Companies like Afresh and SkyCell may be well positioned to exit in the next few years, representing the first liquidity events for venture-backed startups in the industry.

Drivers of success

Afresh* is one of the strongest performers in this category, with a focus on food preservation and waste reduction.

There are several factors that drive success for Afresh:

1) Software with multiple modules to address key customer needs that fit into existing workflows.

Afresh analyzes food waste at grocery stores and shares insights on what is being thrown away. The company pairs these insights with inventory data and other workflows in store, offering optimized store ordering, inventory management, merchandising, and delivery order management products, among others.

2) Clear path to both cost reduction and revenue generation for customers.

Afresh helps its grocery customers understand not only what food has been wasted and therefore lost as revenue, but also what SKUs are understocked, and therefore lost as unrealized opportunity in the fresh produce, meat and seafood aisles.

According to Pitchbook, the company generated $10M in revenue in 2022, and has since expanded its product offerings beyond food waste analytics to launch a new AI ordering and inventory management platform at all Alberstons meat and seafood counters across the US (PR Newswire, Nov 2023).

*Note, SCC GP Shayna Harris invested in Afresh via Portfolia’s Food and Ag Fund.

Where cold chain and food preservation companies struggle

Not all business models are a fit for venture scale. There are several areas where we see companies struggle to achieve returns that are a good fit for venture capital:

1) Data without action.

Sensors have been available for cold chain monitoring from as early as 1992 (SensiTech). Solutions that simply provide monitoring data fail to help the vast majority of customers (such as restaurants or commercial kitchens) improve outcomes in a manner that justifies the expense of installing sensors and paying a subscription for data access.

Ex: SensiTech

2) Hardware that requires customization or significant capital investment.

Customized hardware solutions are difficult to scale. Companies working on custom solutions tend to spend significant time and effort on designing their solutions to customer specifications, effectively acting as consultants in many cases. Scale is directly tied to the hours and availability of the company’s experts who design and size the solution.

For plug-and-play hardware solutions, challenges remain. Startups in particular struggle to fund R&D and manufacturing with the high working capital costs associated with first-of-a-kind hardware products. Solutions that require either the customer or the company to take on significant capital costs can be hard to justify in a relatively low margin industry like food/agriculture, which then puts pressure on startup margins and business models (ie, direct sales or hardware-as-a-service). These challenges tend to intensify over time as startups test and learn to find product market fit.

Ex: MultiVac (vacuum packaging), ProPac (MAP equipment)

3) Specialized software solutions with limited opportunity for product extension.

Software solutions in this space need to be holistic. Software that optimizes energy consumption but does not provide adjacent value to customers – such as predictive maintenance for refrigeration units, or health and safety data to share with health inspectors – will struggle to earn budget allocation from customers who are more likely to adopt one provider who can do it all.

Ex: Software that only focuses on one variable (ie, energy consumption) instead of the overall digitization and optimization of a customer’s operations

4) Software that does not fit into existing workflows. The food and agriculture supply chain is complicated, and there are many hands (and forklifts) that move food from fields to trucks to storage facilities to kitchens and grocery stores along the way. Software needs to enhance existing workflows instead of creating new ones in the context of these moving pieces.

Ex: Restaurant ordering and inventory software that does not consider the workflows of the food distribution value chain

Where we’re investing our time and capital

At Supply Change, we have already been putting capital to work in these opportunity areas. We recently invested in Terrantic, a company that brings actionable insights and line layout optimizations to produce packhouses. Their first use case focuses on apple and tree fruit packhouses looking to maximize their revenue from the fruits that are harvested, stored, and then distributed and sold throughout the year, sometimes many months post-harvest.

As we continue to evaluate the sector, we are most excited about companies that:

Focus on cold storage optimization or cold chain transportation optimization

Address an underserved part of the market, such as food service;

Have solved a customer problem for the right value - the cost of the product is offset by significant customer savings or revenue generation; and/or

Are building optimization and forecasting software to reduce waste/energy consumption for a part of the value chain that has not yet seen a proactive solution

If you’re building in the cold chain/food preservation space, share your opportunity here. We’d love to hear from you!

Appendix

How does the cold chain work in the US for moving goods from place to place?

Cold chain in the United States is typically a patchwork of cold storage and cold chain transport, including refrigerated trucks and shipping containers. For fresh produce harvested in states like California and Arizona, pre-cooling to get the produce within 15% of the target temperature for cold storage is often the first step post-harvest to reduce the energy requirements of cooling the food (PostHarvest). After the food is sufficiently cooled, it is transported in refrigerated trucks to distribution centers. These distribution centers then transport the pallets to retailers or other B2B customers, such as food processors, who will choose to accept or reject any of the pallets included in a given shipment.

The market for cold chain storage in North America is dominated by two companies, Lineage Logistics and Americold, which collectively represent 71% of cold chain storage facilities on the continent (CBRE). There is also growing interest from real estate and private equity investors in cold storage assets (CBRE), representing a strong trend toward continued consolidation in the cold storage sector.

Though both Lineage Logistics and Americold offer cold chain logistics services in addition to storage (Lineage, Americold), the market for cold chain logistics is much more fragmented and competitive (Fortune Business Insights).