Is the Cold Chain a Sleeping Giant of Innovation?

An Analysis & Market Map for Food and Ag Supply Chains

Cold chain innovation is an attractive and largely overlooked market and it is critical to ensuring food sustainability, safety, and health. At Supply Change Capital we believe innovation in cold chain has the potential to transform the food industry and we are excited to connect with companies creating disruptive solutions in this space.

The market is growing and it’s ripe for innovation

526 million tons of food, 12% of the global production total, spoils each year due to lack of access to a safe and secure cold chain; ReFed estimates the U.S. spends $218 billion to grow, process, transport and dispose of food that is never eaten. While globalization, a growing middle class, an the rise of e-commerce are helping improve access to the cold chain, the leading products in the market are not sustainable with the current solutions. The cold chain is responsible for ~4% of total global greenhouse gas emissions (including emissions from cold chain technologies and food loss caused by lack of refrigeration).

Current technologies lack supply chain visibility, require high amounts of energy, and rely on ozone-depleting CFCs and HCFCs. Fortunately, these conventional options aren’t the only product offering. New technologies that leverage IoT and AI, innovative packaging, and sustainable refrigerants aim to increase access to healthy and fresh food, reduce waste, and avoid harmful GHG impacts. These solutions are nascent but growing quickly and need more cash and guidance to scale.

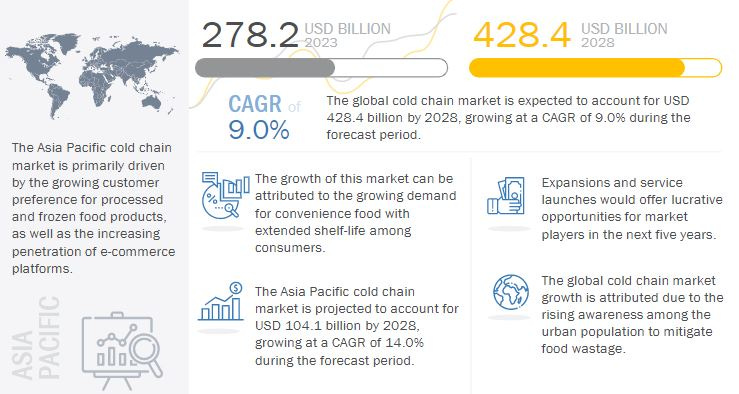

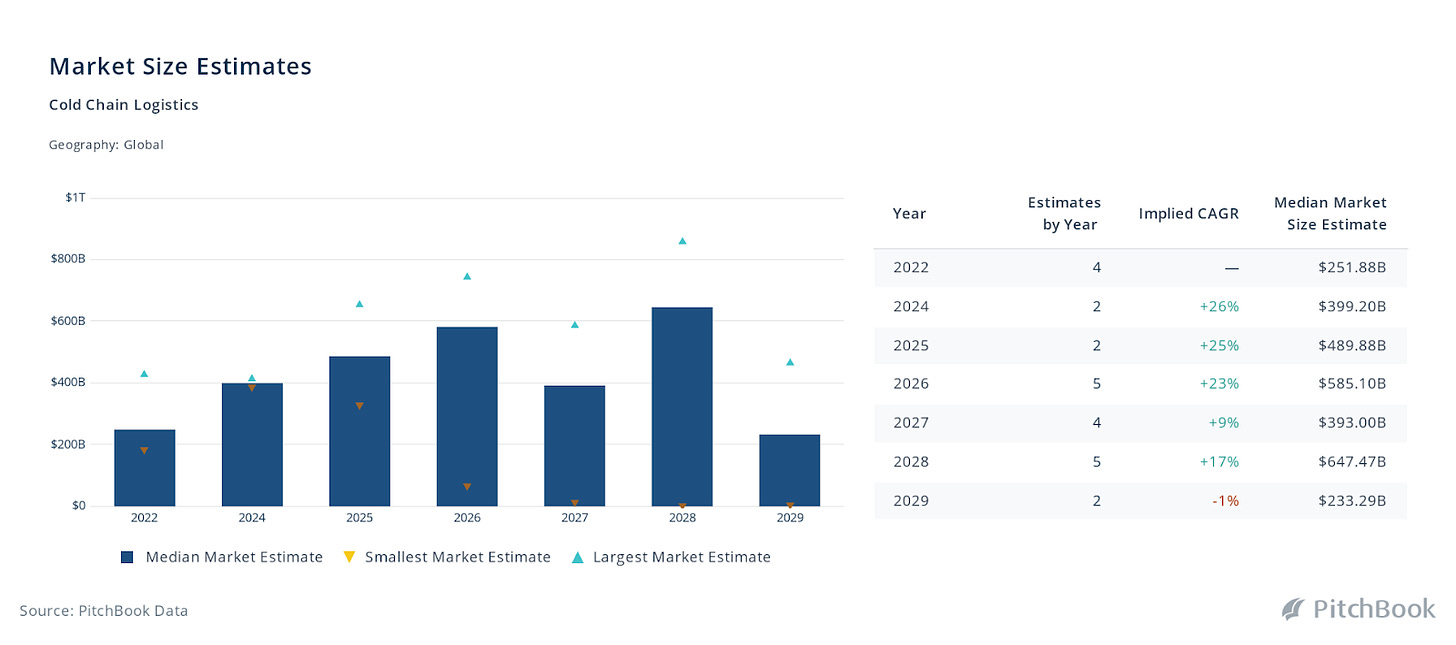

The global cold chain market is on the verge of an upswing, projected to achieve between a 9-17% CAGR and reach somewhere between $428B and $647B by 2028 from an estimated $278B in 2023 (See Exhibits 1 & 2). At Supply Change Capital, our focus is on supporting innovative entrepreneurs accelerating the transition to a healthier, more diverse, and environmentally-conscious future of food and we believe investing in the food cold chain has the potential to transform our food system for the better.

Figure 1: Global Cold Chain Market Trends (Source: Markets & Markets)

Key market drivers

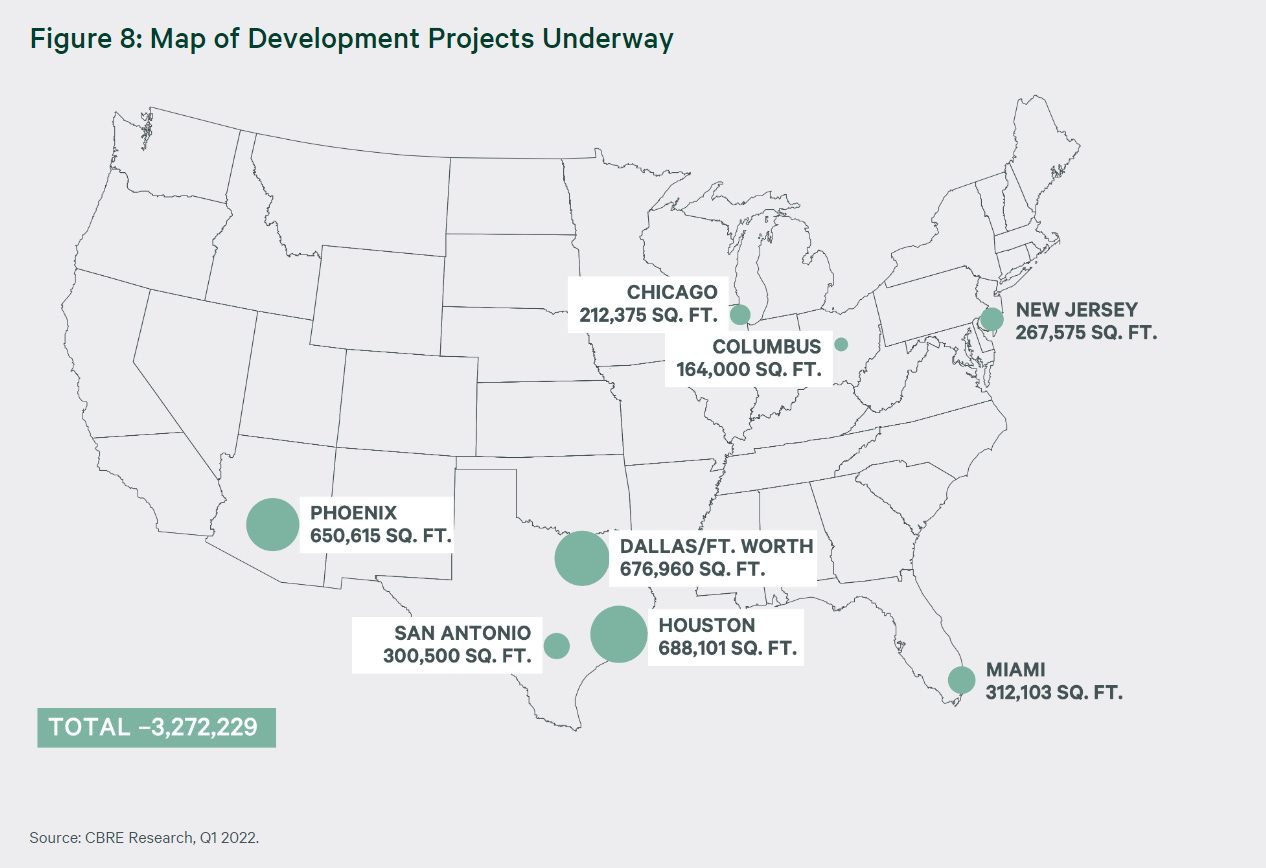

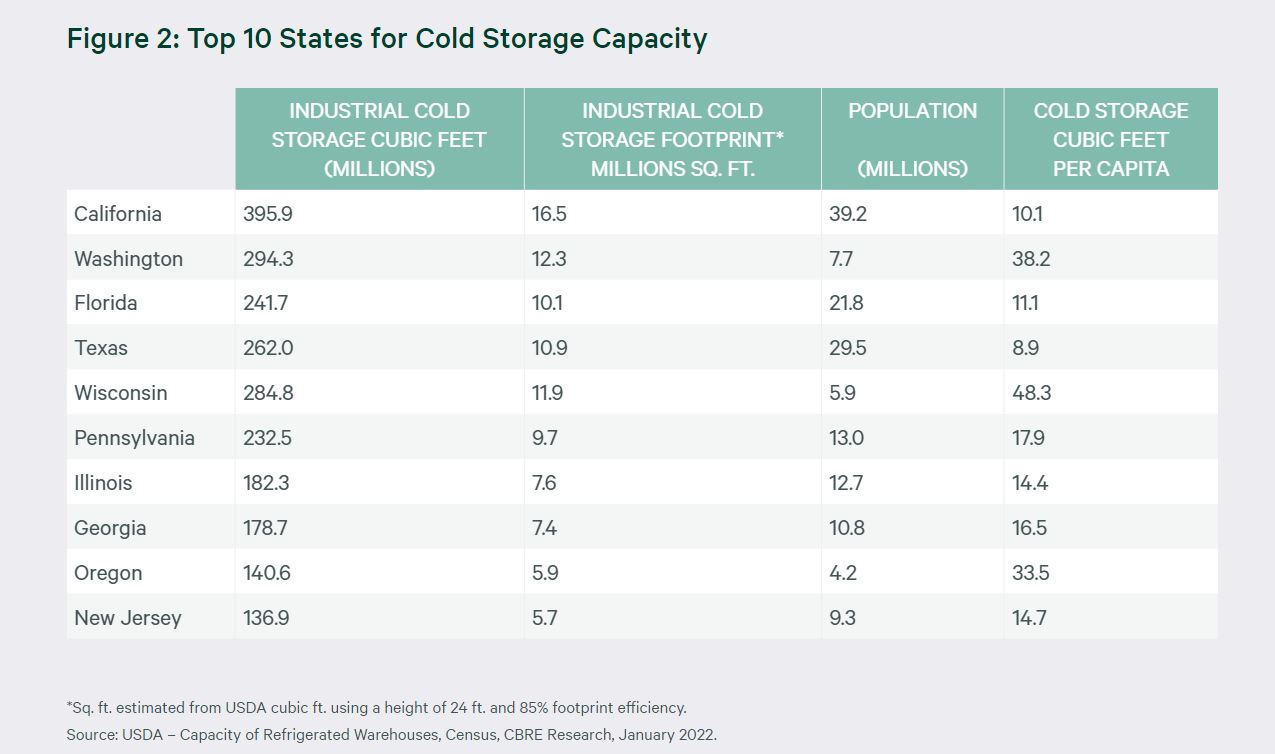

Globalization and a growing middle class: Middle-class consumers and developing nations are increasingly seeking fresh and frozen foods as healthier alternatives to existing diets leading to a growing demand for temperature-controlled logistics. China and India’s cold chains are reported to be growing 25% per year (Exhibit 3) and demand for cold chain development is surging in areas of high population growth in the US such as Texas and Florida (Exhibit 4 & 5).

The rise of e-commerce: The explosive growth of e-commerce is driving demand for cold chain logistics during last-mile delivery (online purchasing of refrigerated and frozen foods rose 58% YoY as of October 2021).

Increased demand for sustainability: Sustainability and supply chain resilience and visibility have become top priorities for corporates and logistics providers in recent years increasing the demand for monitoring and tracking, operational efficiencies, and sustainable alternatives to packaging and refrigeration.

Key opportunity areas

To better understand the opportunity, we created a market map identifying startups building solutions across four areas we believe are attractive for venture and provide the most potential to improve the efficiency, safety, and sustainability of the food cold chain. IoT technologies and AI are providing solutions to supply chain traceability and optimization. Improved packaging products are reducing waste, energy consumption and negative environmental impacts. Off-grid refrigeration technologies are increasing access to the cold chain in rural and developing areas and lastly, alternatives to traditional refrigerants are providing eco-friendly solutions that eliminate reliance on CFCs and HCFCs.

1)Adoption of AI and IoT-based technology: One of the biggest challenges in the cold chain is the need to maintain consistent temperatures across the supply chain. A multitude of logistics providers across production, warehousing, transportation, and retail make temperature data collection and monitoring especially difficult. IoT technology can be used for real-time temperature monitoring and traceability to ensure consistent temperatures across transport and storage ultimately reducing spoilage. Startups are creating smart monitoring sensors that track temperature, humidity, and other environmental factors and will alert logistics companies about any unwanted changes.

In some cases, these startups also provide data analytics and AI-driven predictive modeling to anticipate and reduce unwanted changes. Once data is compiled using IoT technology such as sensors and barcodes, AI can be used to analyze this data to ensure food quality and safety, as well as to predict when equipment is likely to fail, preventing costly breakdowns en route. AI can optimize energy efficiency across warehouses and transportation reducing energy consumption and costs.

Roughly 35% of trucks on the road in the US travel empty accounting for 87 million metric tons of unnecessary annual emissions. AI can improve inventory management and route optimization to reduce inefficiencies and waste. Warehouse automation presents a growing investment opportunity as warehouse automation investment is expected to reach $69B in 2025 up from $30B in 2020 according to Interact Analysis. Additionally, AI can be used to analyze relevant data such as weather and other hypothetical supply chain disruptions to predict demand for temperature-sensitive products. AI allows companies to better assess supply chain risks and model responses to hypothetical breakdowns across the life of the product. The introduction of AI into the cold chain provides significant opportunities for increased efficiencies and cost savings. McKinsey estimates an addition of $127B in topline revenue by 2030 should AI be used to manage waste from farm to fork.

Notable startups in this space: Afresh, Shelf Engine, Varcode, Smartsense, Agrofresh, ClimateAI, Samsara, FoodMaven

2)Innovative Packaging: Packaging plays a critical role in the cold chain process ensuring products maintain their quality and safety throughout the supply chain. Innovation in packaging can improve efficiency and sustainability by reducing waste, energy consumption, and environmental impacts. The global cold chain packaging market size was valued at $22B in 2022 and is expected to grow at a CAGR of 19.6% from 2023 to 2030. New solutions such as smart packaging, advanced insulation materials, eco-friendly packaging, and phase change materials are on the rise and are expected to continue to evolve as technology advances.

Notable startups in this space: Temperpack, Artyc, Vericool, Zume, Loop Industries, Tan90, OAL, bluwrap

3)Servicing the Off-Grid Refrigeration Market: A significant portion of the population lacks access to refrigeration due to a lack of energy security. For example, 83% of people in sub-Saharan Africa lack access to refrigeration. There the off-grid refrigeration market for small businesses that rely on refrigeration for income generation is $3.1B. Innovative solutions to refrigeration that sidestep the need for traditional energy inputs and consistent access to the grid are popping up across developing nations reducing food waste, increasing food security, and reducing emissions by replacing high emitting generators. Startups are providing solutions that leverage solar power and innovative financing platforms.

Notable startups in this space: Solar Freeze, Koolboks, ColdHubs, Ecozen, InspiraFarms

4)Alternatives to traditional refrigerants: Traditional refrigerants such as CFCs and HCFCs are significant contributors to global warming and are typically high consumers of energy. In response to these dated technologies, startups are developing more efficient and environmentally-friendly alternatives. It’s worth noting that longer production timelines due to challenges around scaling and infrastructure may make these investments trickier for VCs.

Notable startups in this space: SureChill, NanoFreeze, Culinary Sciences, Rebound Technologies, Wakati, CoolTech

Conclusion

We anticipate innovation in the cold chain to grow and evolve significantly in the coming decade. As supply chain resilience becomes increasingly important and the need to address climate change and our growing population becomes unavoidable, the demand for solutions that provide real-time data and visibility across the supply chain, use AI-driven modeling and decision making, leverage innovative alternatives to existing packaging and refrigerants, and service off-grid markets will continue to grow. We are excited to engage with founders and start-ups working in this space to help accelerate the commercialization of these technologies at scale.

If you’re building something in the food cold chain or want to discuss innovation in the industry, please share your opportunity here.

EXHIBITS

Exhibit 1:

Source: Pitchbook

Exhibit 2:

Source: Pitchbook

Exhibit 3: Cold Chain Logistics Company Count Breakdown by Geography

Source: Pitchbook

Exhibit 4: Cold Chain Development Projects in the US

Source: CBRE

Exhibit 5: Top States in US for Cold Storage Capacity

Source: USDA

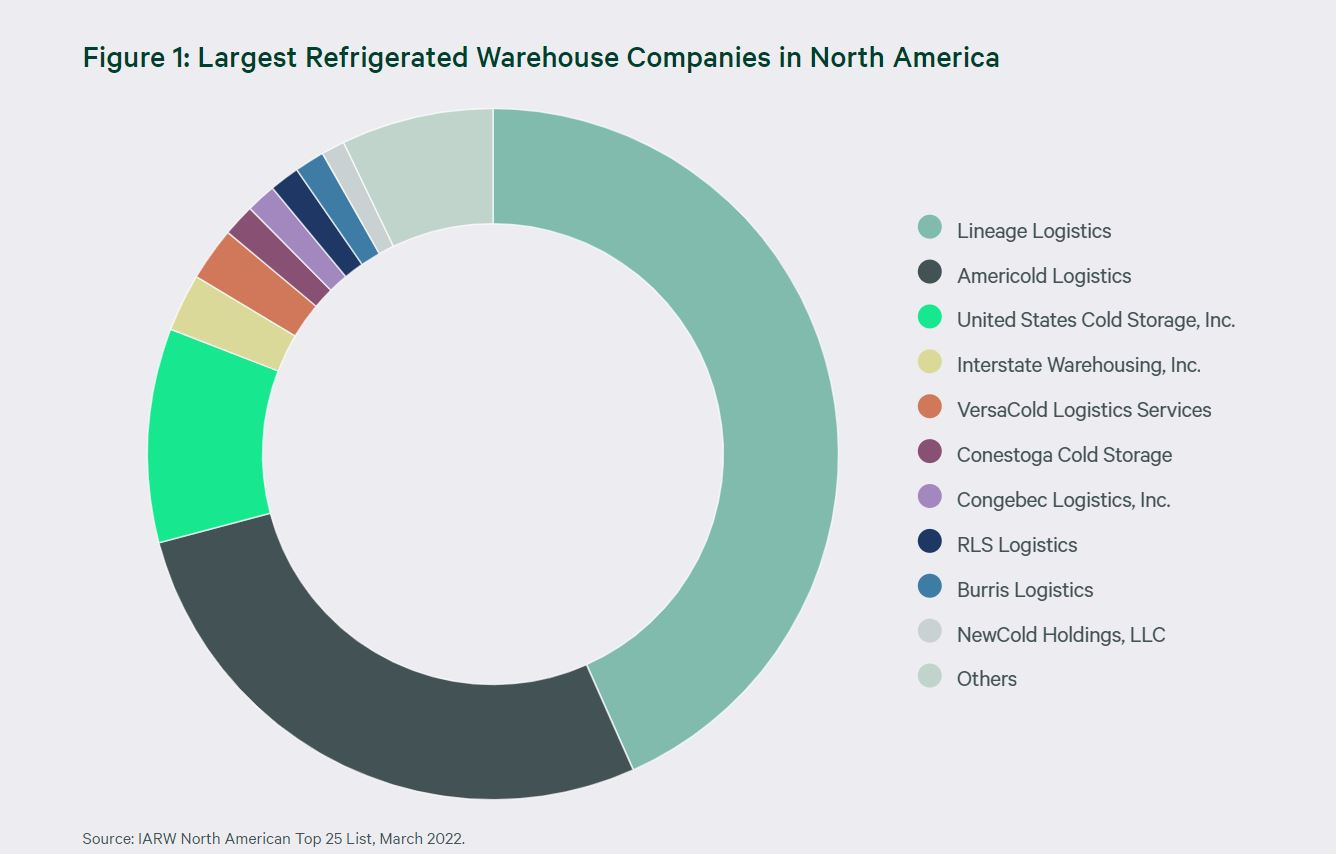

Exhibit 6: Top Cold Chain Logistics Providers

Source: IARW

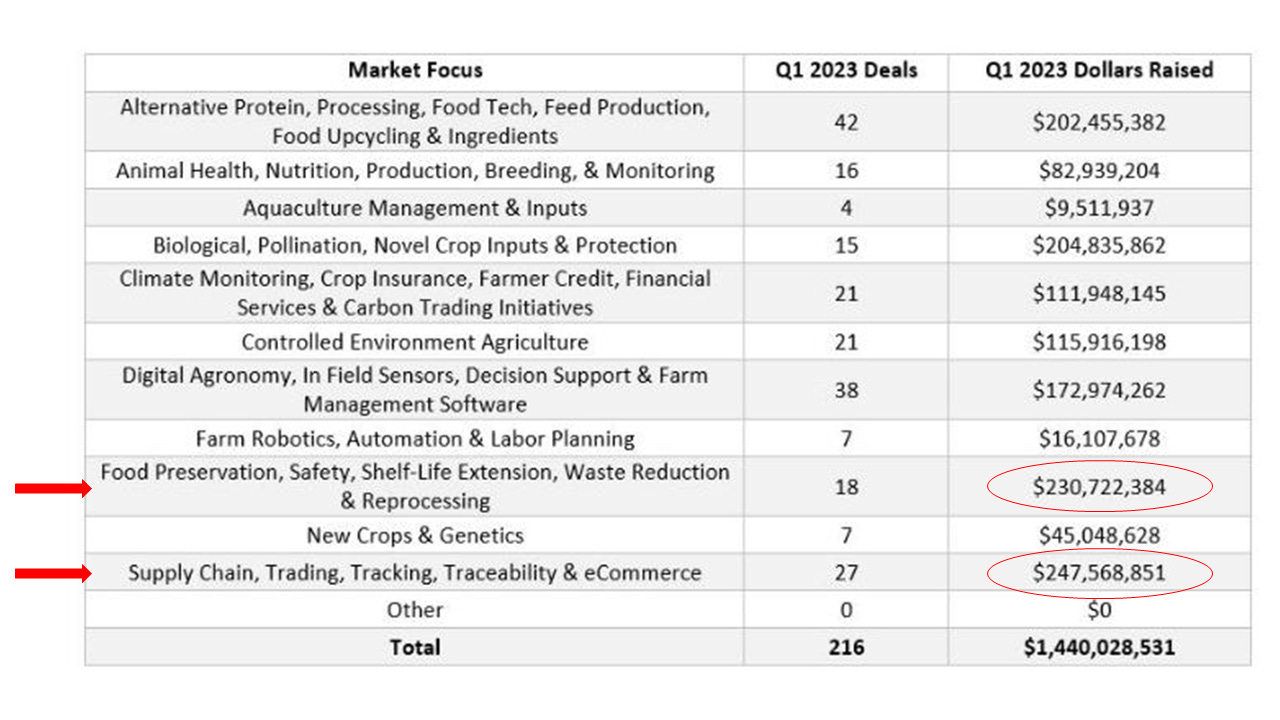

Exhibit 7: Q1 2023 AgTech VC Investment