As the new year begins, it’s always humbling to pause and reflect on the journey—the successes we’ve celebrated, the challenges we’ve faced, the surprises we’ve encountered, and the lessons we’ve learned along the way. Later this month, we’ll return to the Grand Canyon State for our annual GP retreat. This retreat has become a cornerstone of our rhythm—a chance to step away from the daily grind of running a firm, raising capital, evaluating deals, and supporting our portfolio companies through challenges big and small.

As we approach Supply Change Capital’s fifth anniversary, this annual tradition holds even greater meaning. It’s our dedicated time to pause, reflect, and take stock, allowing us to envision the road ahead with renewed clarity and purpose. We treasure this blue-sky thinking—a moment to dream boldly, strategize thoughtfully, and recommit to our mission.

Consider this post a prelude to that process, a look back at some of the highlights and results that defined 2024. It’s a celebration of progress and a preparation for the planning that will shape the year to come.

Highlights:

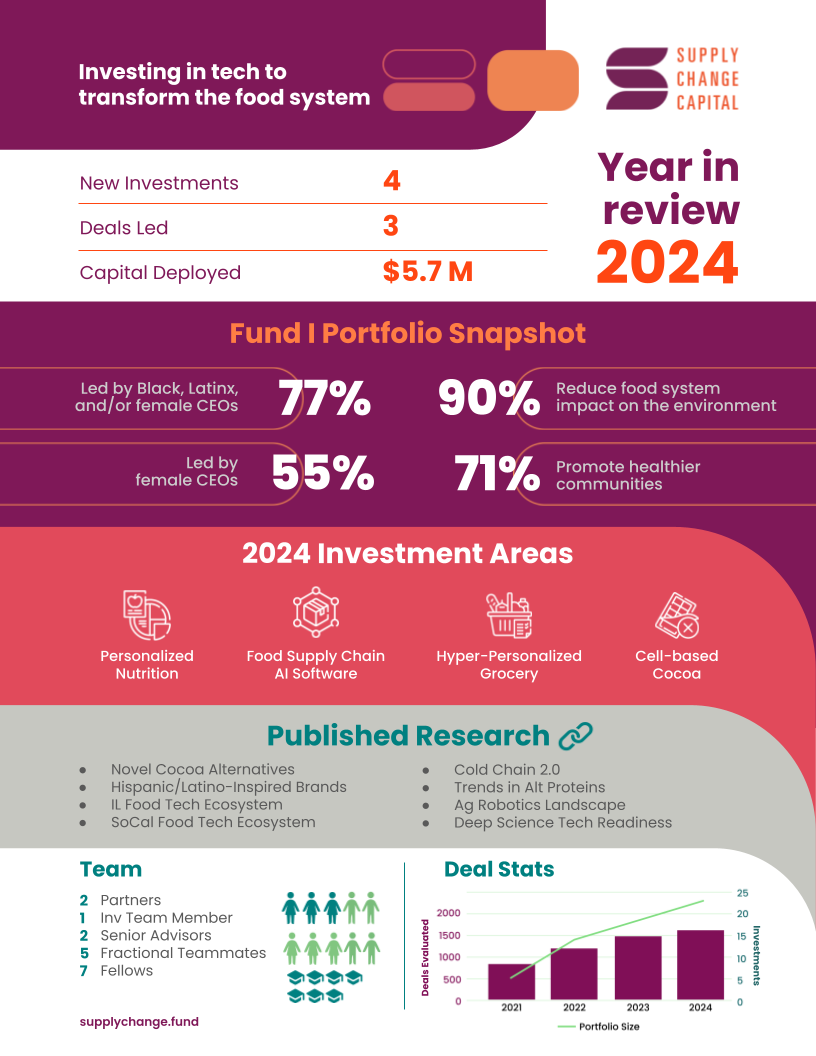

We made four new investments: Terrantic, Verve Market, Celleste Bio, and bitewell

We led three of these four investments (2 Seed, 1 PreSeed) with an average check size of $1.3M

We published our 2023 Impact Report highlighting the incredible work of our portfolio

We published nine proprietary reports covering topics from novel cocoa alternatives to Hispanic-heritage brands to cold chain 2.0 and how we evaluate deep science technology readiness

We launched our second fund to extend our platform for investing in early-stage technology to transform the food system!

Fund I Overview

AUM: $40M

Vintage: 2021

Capital Deployed: $21M

Portfolio Size: 22

Deals Led 7 (32%)

PreSeed/Seed/Other: 37% / 61% / 2%

Deal Flow Powered by Research

In 2024, we published eight reports that further explore our investment thesis. With decades of sector experience in the food, supply chain, and logistics industries, four years of deal flow data, and insights into downstream investment trends, we are increasingly positioned to conduct outbound research to identify investment opportunities. Our research drives investments and impacts the speed with which we are able to evaluate deals. The research pieces are linked below:

Throughout 2024, we saw 1572 deals, over 150 deals more than we saw in 2023 and 50% more than we saw in 2022. For the 4 investments we made this year, our average diligence time (from intake form to investment decision) was 80 days.

New Investments

We made four new investments and five follow-on investments this year. New investments included sectors such as:

Personalized nutrition

Hyper-personalized grocery

Food supply chain AI software

Novel cocoa alternatives

We led three of the four new investments (2 Seed, 1 PreSeed) with an average check size of $1.3M. This brings the percentage of deals led to 32% thus far, which is in line with our fund model expectation of leading ⅓ of deals.

Growing our Team

This year, Neil Willcocks, former VP of Mars Wrigley R&D, joined us as Senior Advisor and Venture Partner. Read more about Neil’s work and interests here. We also hosted seven graduate fellowships; fellow Minami Ogawa wrote about her experience in this reflective post. Thank you to our 2024 talent partners:

UC Davis’ Innovation Institute for Food & Health

MIT’s Sustainability Initiative

Chicago Booth’s VC Lab

PledgeLA

HBCUvc

Driving Community through a Systems-Oriented Approach

We approach our work with a systems-lens. It is how we’ve developed and nurtured deep networks over the last two decades, and it is the type of work that helps us avoid the “Sunday scaries.”

This community-first approach helps us build deal flow, nurture co-investment relationships, and advance equity of opportunity in venture capital and the food ecosystem. This past year, we enjoyed leaning into the AllRaise, Journey to Lead, and PEWIN networks, and participating in the ReCast, Citizens Private Bank, and Food Hack Summits.

Our team's influence continues to expand across the industry. Shayna took on Advisory Board roles at Innovation Zero America Congress and Future Food Tech, while Noramay participated in a distinguished White House gathering of Latina/o venture capital leaders. Rachel co-hosted a cold chain event during NY Climate Week. Also, she kicked off a cadence for sharing and requesting co-investment opportunities, building on our national network of investor friends and colleagues.

Supply Change Capital was a proud Angeles Estrellas Award honoree again this year; this award highlights top funders and venture capital firms with a history of investing in Hispanic and Latino/a-led companies. Our commitment to advancing inclusivity in investment management earned us a spot on Blueprint Capital Advisors' first-of-its-kind DEIC Power 100 list.

As a result of this work, Noramay was recognized as a “Most Inspiring Emerging Manager” by PledgeLA, a coalition of tech companies and VC firms sponsored by the Annenberg Foundation and the Office of the Mayor of Los Angeles. She was also recognized as a Pioneer Woman of the Year by the City of Los Angeles’ Commission on the Status of Women. Shayna was named one of 101 ‘Women from Across the Globe Focused on Unlocking Climate and Sustainability Solutions’ by Fin-Erth in partnership with L'Oréal, MSCI Sustainability Institute, and S2G Investments. She was also acknowledged as one of the ‘10 Emerging VC fund Managers to Watch’ by Venture Forward.

What We’re Most Looking Forward to in 2025

More, more, and more! But also less! More investments, more partnerships, more thriving companies, more soul-filling collisions, more efficiencies, and more rest. And also less – less travel, less breadth, and less burnout. During our upcoming team retreat, we'll set our annual goals and intentions for the year ahead.

In Summary

About a year ago, OpenLP—a knowledge-sharing platform created by fund-of-funds manager Sapphire Partners—made a striking prediction: if success rates for fund managers were to drop by 5–15% from historical averages, up to 347 first-time managers could exit the market due to the challenging leap from Fund I to Fund II.

In this challenging environment, we have much to be grateful for. Our continued momentum in growing our platform and the thriving ecosystem we’ve nurtured are sources of immense pride and motivation. As we look ahead, we’re energized by the opportunities to build on this foundation and excited for what this next year holds.

And, we invite you to join us on the journey. How?

Subscribe to our monthly newsletter here.

Submit a deal here.

Subscribe to our blog here.

Learn more about our approach via our website.

Reach out to hello@supplychange.fund for a chat!

With love, us